A Comprehensive Guide to Understanding Transactional Funding

Transactional funding is a type of loan that enables real estate investors to quickly close on a transaction without having to wait for traditional financing. Providing short-term funds, allows investors to purchase properties and flip them for profit. In many cases, this type of funding can be used in combination with traditional financing or as a stand-alone solution.

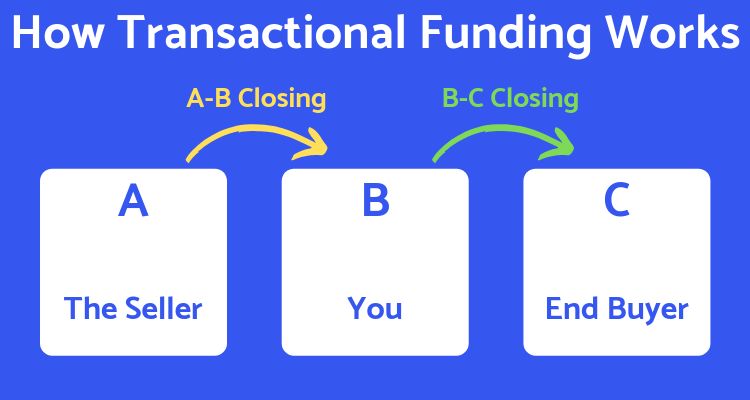

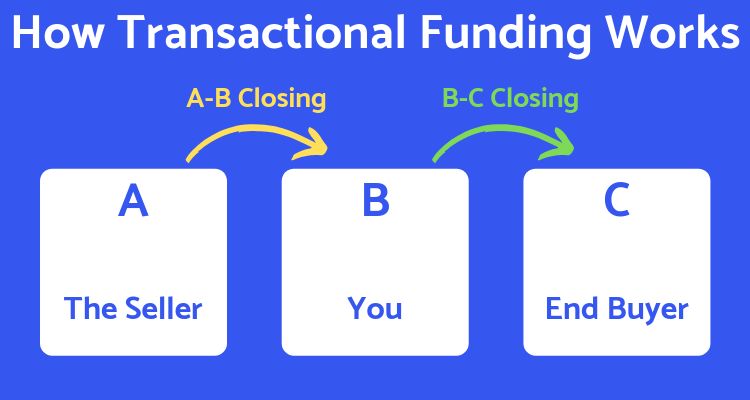

Transactional funding works by providing short-term, high-interest loans to real estate investors. The investor will use the funds to purchase a property, typically within a few days. Once they’ve closed on the property, they will then quickly resell it to an end buyer and pay off the loan, plus any associated fees and interest charges. Because these types of transactions are often short-term in nature, these loans often have higher interest rates than conventional mortgages or home equity lines of credit (HELOCs).

Several benefits make transactional funding attractive for real estate investors:

• Speed – One of the major advantages of transactional funding is its speed. In most cases, you can get your funds within a few days–compared to weeks or months with traditional mortgages or HELOCs. This makes it easier for you to take advantage of investment opportunities that may come up unexpectedly.

• Low capital requirements – Depending on the lender, you may not need a large amount of money as collateral when applying for a transactional loan. This can be especially useful if you don’t have access to much capital but still want to invest in real estate.

• Flexibility – Since transactional loans are short-term, there’s more flexibility when it comes to repayment terms and costs. You don’t have long-term obligations like with other types of financing options. And since you’re only responsible for paying off the loan once you’ve resold the property at a profit, there’s less risk involved compared to other types of investments such as stocks or bonds.

• Tax advantages – Depending on your situation, you may also be able to take advantage of some tax advantages when using a transactional loan instead of other forms of financing such as mortgages or HELOCs. For example, if the property isn’t your primary residence and you’re making profits from flipping it, any gains could qualify as capital gains income which has different tax implications than regular income such as wages or salaries.

There are several different types of transactional funding options available depending on your needs:

• Hard money loans – These are usually provided by private lenders and require some form of collateral, usually in the form of real estate, land, business equipment, etc. They tend to have shorter term lengths (usually 1 year or less) and higher interest rates than conventional mortgages. They also come with stricter repayment conditions.

• Private lending network – Private lending networks match borrowers who need short-term capital with lenders who can provide them. These networks offer more flexibility than hard money lenders since terms and conditions can vary widely between lenders. Many times, there is no collateral required which means no liens against your properties if something goes wrong with repayment. But this also means higher interest rates due to increased risk for lenders.

• Direct bridge lender – A direct bridge lender is an intermediary who helps connect borrowers directly with institutional lenders so they can access larger amounts of financing at competitive interest rates. The main benefit here is access to larger sums combined with lower risks since institutional lenders generally have more stringent underwriting standards than private ones.

As with all financial transactions, there are risks associated with transactional funding that should be considered before making any commitments :

• Repayment default – If you fail to repay your loan according to terms, then there is always the risk that the lender will take legal action against you to recover their money. If this happens, then any liens placed upon your assets could cause serious financial problems.

• Interest rate fluctuations – Since most transactional loans carry variable interest rates unlike fixed-rate mortgages, they are subject to change based on market conditions which could affect how much money you ultimately owe back to the lender over time.

Choosing the right type of transactional funding depends largely on what kind of investor you are: Are you looking for quick cash flow? Do you need capital fast? Or do you want access to larger sums at lower interest rates? Here are some tips for finding the right option for you:

• Understand your goals – The first step is to understand what you hope to achieve by using a transactional loan. Knowing this will help you narrow down the type of loan that best fits your needs.

• Shop around – It’s important to do your homework and shop around for the best deal. Don’t settle for the first option that comes along; compare different rates, terms, lenders, etc. so you can get the most bang for your buck.

• Read all the fine print – Make sure you read through all of the documents related to the transaction carefully before signing anything. This includes any contracts or agreements between you and the lender so you know exactly what you’re getting into.

• Consider the tax implications – Transactional funding typically has different tax implications than regular income such as wages or salaries. Make sure you understand these and are prepared for any additional taxes that may be due.

By understanding your goals, shopping around, reading all the fine print, and considering the tax implications of transactional funding, you can make an informed decision and choose the right option for your needs. With a little bit of research, you can find a loan that meets your needs without sacrificing too much in terms of risk or cost.

By understanding your goals, shopping around, reading all the fine print, and considering the tax implications of transactional funding, you can make an informed decision and choose the right option for your needs. With a little bit of research, you can find a loan that meets your needs without sacrificing too much in terms of risk or cost. Different types of transactional loans come with different risks and benefits, so it’s important to understand your options before deciding which one is best for you. For example, private lenders may offer faster access to funds but also carry higher interest rates due to increased risk for lenders whereas direct bridge lenders may provide larger sums at lower interest rates but require more stringent underwriting standards from borrowers. Ultimately, the choice comes down to understanding your risks and goals and finding the best fit for both. By considering these steps, you can ensure that you make an informed decision about which transactional funding option is right for you.

To sum up, it’s important to consider the risks associated with using transactional funding, including repayment default and interest rate fluctuations. It is also important to understand your goals and shop around to find the best deal available. Furthermore, be sure to read all the fine print before signing any agreements and take time to consider any potential tax implications of taking out a loan. With careful consideration and research, choosing the right transactional funding option doesn’t have to be a stressful experience. By following these steps, you can make an informed decision that helps you achieve your financial goals without sacrificing too much in terms of risk or cost.

September 17, 2024

September 10, 2024

September 3, 2024

August 30, 2024

July 27, 2024

March 14, 2024

March 15, 2023

March 15, 2023

March 15, 2023